They’re popping up everywhere: new apartment buildings all across the Denver Metro Area and Colorado Springs. And with new builds comes new competition, new rental stats, and changes in the market. But according to Zillow, Denver apartment rents are rising and are projected to continue to climb next year.

What Zillow Predicts

According to Zillow’s data, apartment rents in Denver landed at a median of $1,998 back in February 2017, and are expected to keep going up next year, rising to $2,043 according to their projections. That means renters will need a pay increase of over $500 to maintain the same income-to-rent ratio. Based on the year-over-year rates, rents have increased between 1.3% and 1.6% since this time last year.

Head to the Burbs! Or Not…

So if apartment rents downtown are too high, it makes sense to head to one of the outlying suburbs, right? Wrong! According to the Denver Post, apartment rents are actually higher in some of the suburbs, including Highlands Ranch, which has some of the highest apartment rents in the region with two bedroom apartments going for an average of $1,850 per month in comparison to Denver’s average of $1,730.

Heading back to Denver proper, Five Points still tops the list for highest apartment rents. Aurora and Colorado Springs make it on the list of more affordable markets, with one bedroom apartments in Aurora averaging $1,060 and 2 bedrooms $1,390, and Colorado Springs’ numbers come in at $820 for a 1 bedroom and $1,010 for a 2 bedroom.

Compiling The Data

So what does all of this talk and data about apartment rents really mean? For one, it creates direct competition for all of the condos listed out there. In a renter’s eyes, there’s no difference between a condo and apartment, so when comparing the two, they may be more inclined to put their money into the unit offering all of the latest amenities, like wine coolers in the kitchen, roof-top pools, dog spas, etc. Score one for the brand new apartment complex.

It also drives prices down and average days on market up as condo owners and property managers struggle to compete with move-in specials offered by these new complexes. Pulling from our own portfolio over the last 60 days, 47% of condo owners had to drop their price in order to stay competitive and see their unit rented, 66% of which dropped over $100 per month before they finally rented, and the average days on market in the last 60 days for our list of condos was about 21 days.

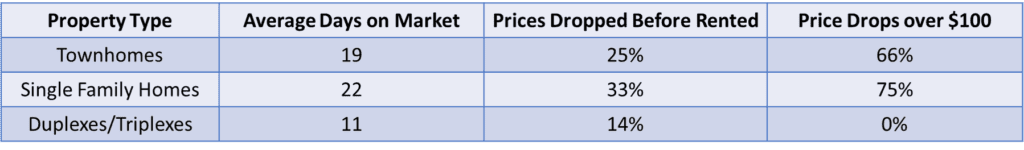

Just for comparison, here are those same stats for Single Family Homes, Townhomes, and Duplexes and Triplexes during the same period: